44+ deductible home mortgage interest worksheet

Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The input within the program is.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Ad Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options.

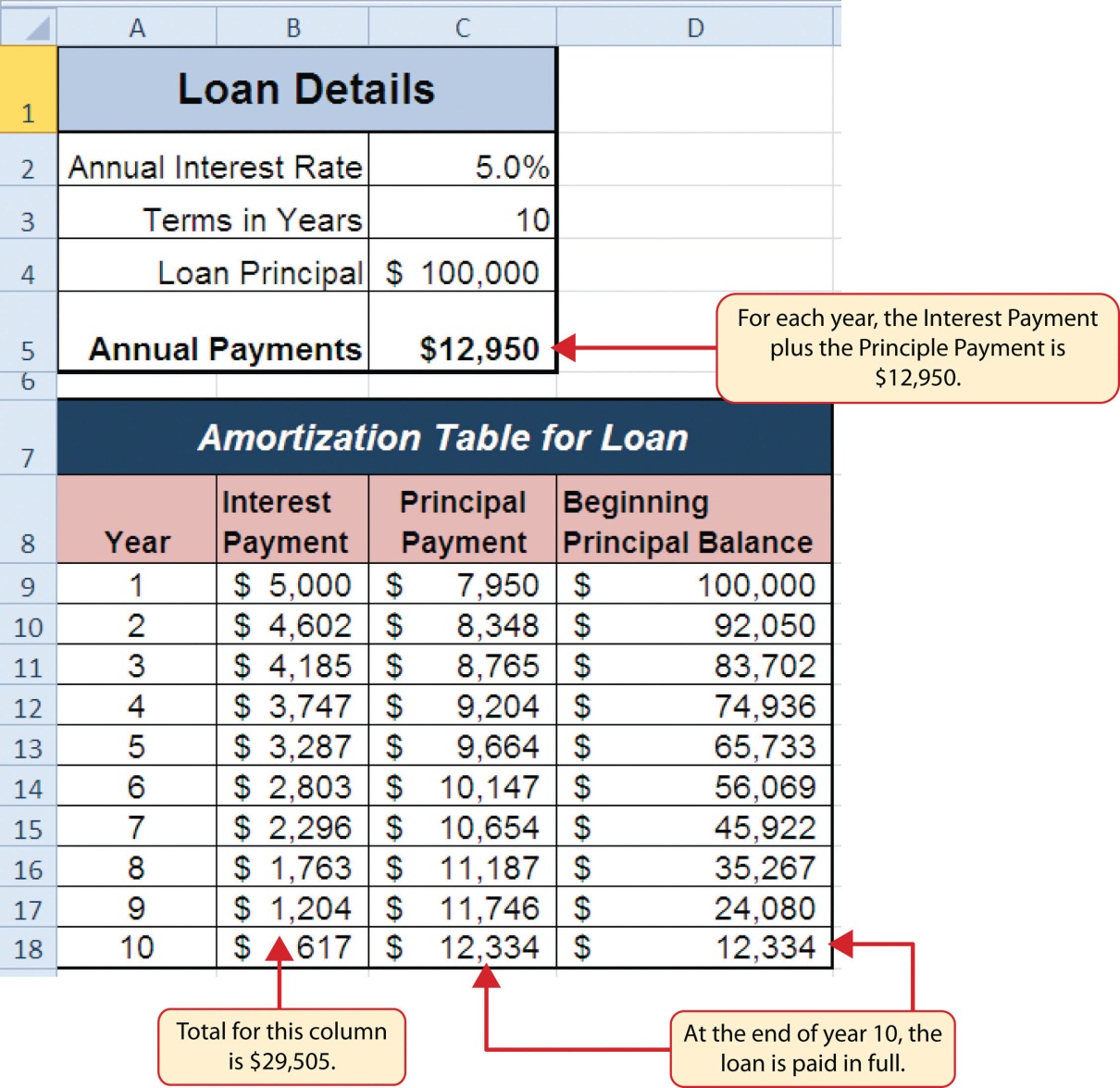

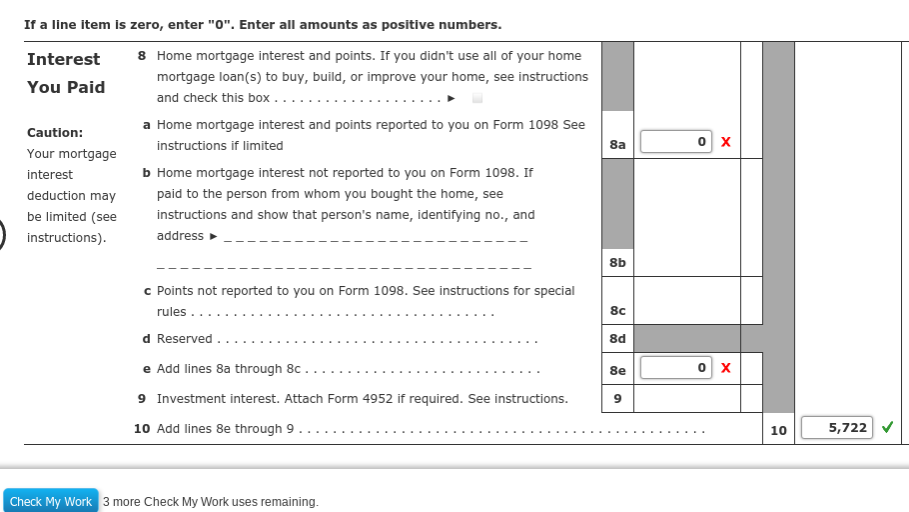

. The finalized worksheet to correctly calculate the mortgage interest. Web Line 11 If you paid home mortgage interest to a recipient who did not provide you a federal Form 1098 report your deductible mortgage interest on line 11. Generally home interest is deductible on a Form 1040 Schedule A attachment if its.

Enter information for up to 4 loans. Compare offers from our partners side by side and find the perfect lender for you. This deduction is capped at 10000 Zimmelman says.

Ad Access Tax Forms. Interest on this mortgage is fully deductible for the. Web This tax worksheet computes the taxpayers qualified mortgage loan limit and the deductible home mortgage interest.

If for any year you elected to claim the foreign tax credit without filing Form Worksheet for Home Mortgage Interest Line 4a Keep for Your Records. They want to know the qualified loan limit and. Web Do you need to file the Deductible Home Mortgage Interest Worksheet.

Web a deduction in that year. Apply Online Today For A Diverse Mortgage Solution To Navigate Your Home-Buying Process. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Ad Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options. Web Enter your address and answer a few questions to get started. Calculating Lower Property Taxes.

Register and Subscribe Now to Work on Pub 936 More Fillable Forms. February 12 2022 808 AM. So if you were dutifully.

Apply Online Today For A Diverse Mortgage Solution To Navigate Your Home-Buying Process. Yes essentially you are running into the same situation. 100 Bonus Depreciation Ends December 31 2022.

Web Go to Screen 25 Itemized Deductions. Web Grandfathered debt - the amount of a mortgage prior to October 14 1987 secured by a qualified home. From the left sections select Excess Mortgage Interest.

Complete Edit or Print Tax Forms Instantly.

Personal Finance 1 Worksheet 11 Worksheet For Calculating The Maximum Monthly Mortgage Payment And Mortgage Size For Which You Can Qualify W11 Method Course Hero

2 3 Functions For Personal Finance Beginning Excel

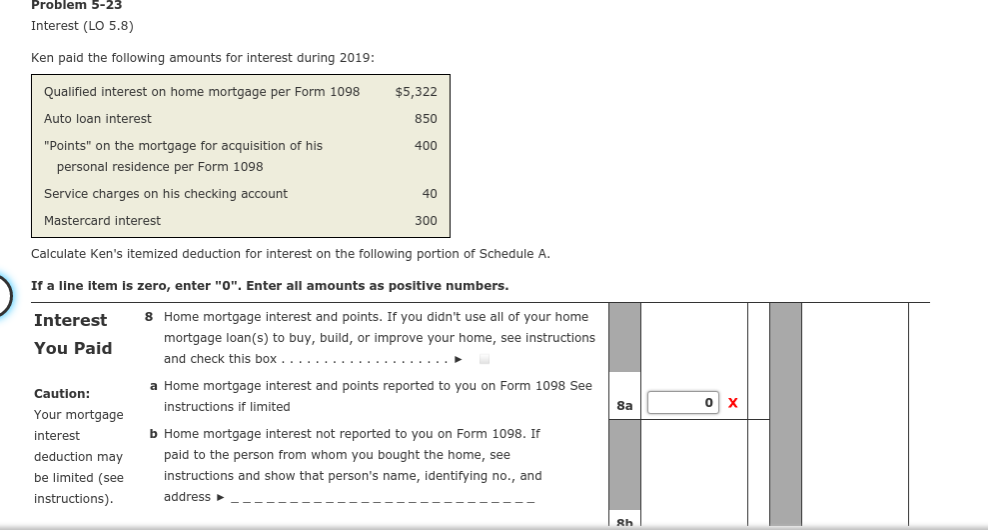

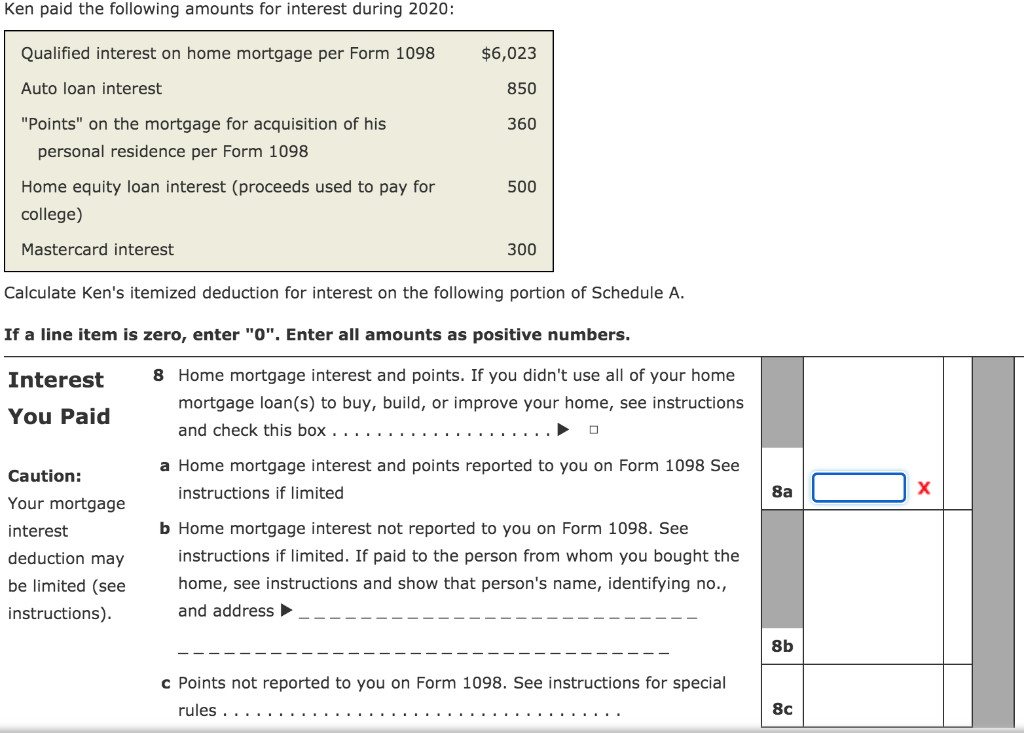

Solved Problem 5 23 Interest Lo 5 8 Ken Paid The Following Chegg Com

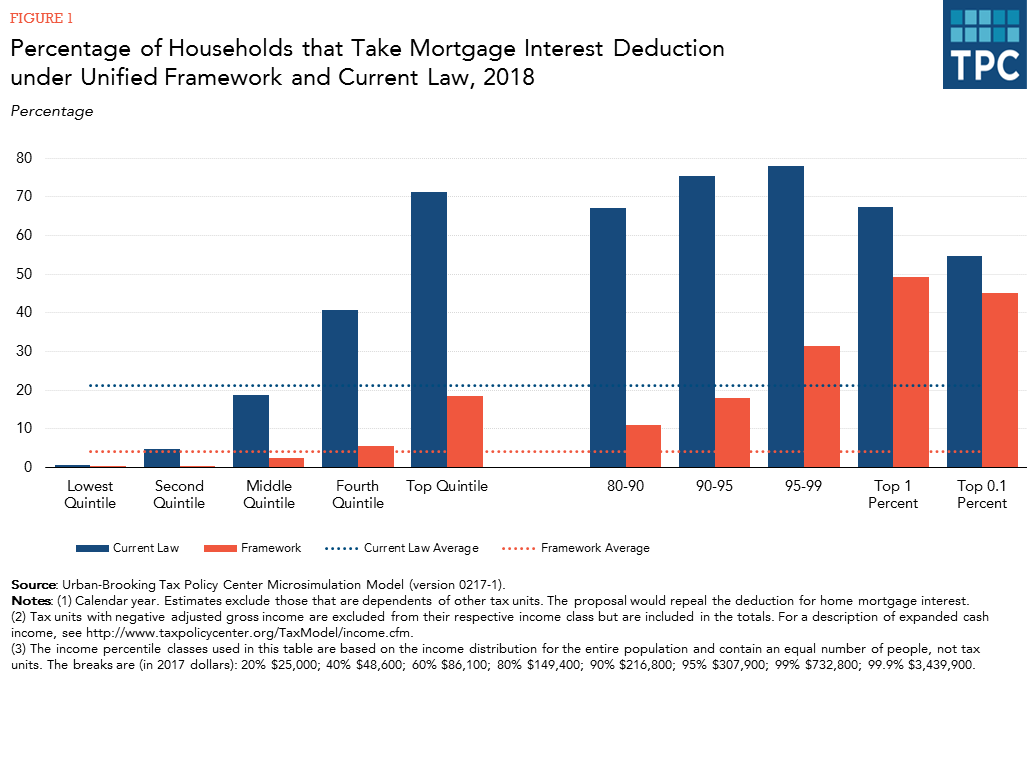

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Debt Service Coverage Ratio Formula Calculator Excel Template

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

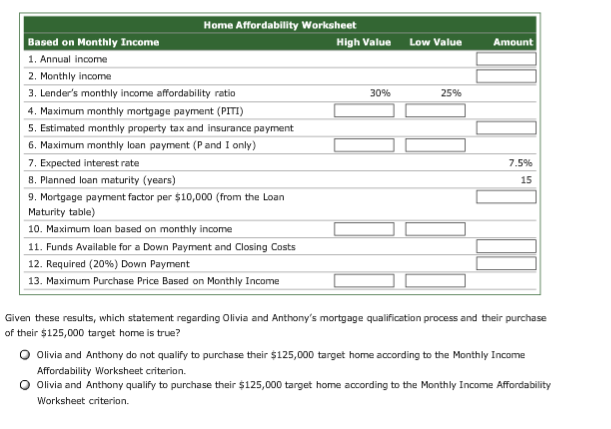

Worksheet For Calculating The Maximum Mortgage Loan For Which You Qualify A Monthly Income Annual Income Divided By 12 B Times 0 28 Percentage Of Course Hero

Solved Home Affordability Worksheet Based On Monthly Income Chegg Com

Solved Problem 5 23 Interest Lo 5 8 Ken Paid The Following Chegg Com

Free Cash Flow Formula Calculator Excel Template

Discount Formula Calculator Examples With Excel Template

Ken Paid The Following Amounts For Interest During Chegg Com

15 Sample Land Contract Forms In Pdf Ms Word

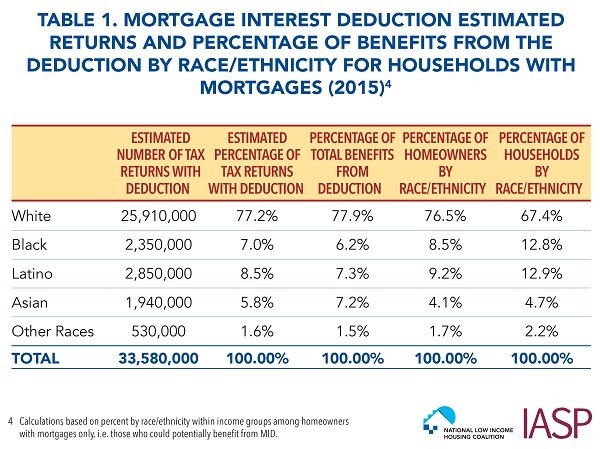

Race And Housing Series Mortgage Interest Deduction

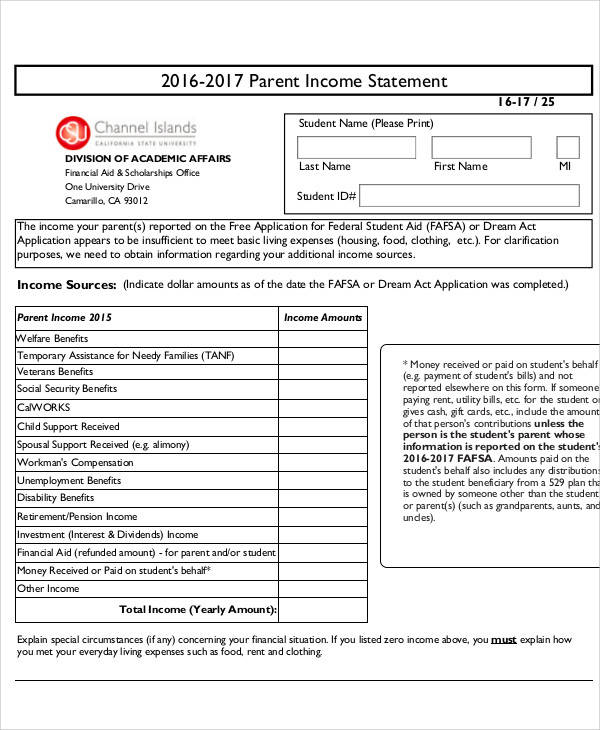

Free 44 Sample Statement Forms In Pdf

Solved Deductible Home Mortgage Interest Worksheet Page 4